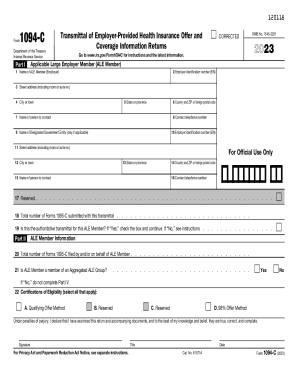

IRS 1094-C 2024-2025 free printable template

Show details

1201181094CTransmittal of EmployerProvided Health Insurance Offer and Coverage Information ReturnsFormDepartment of the Treasury Internal Revenue Serviceman BOMB No. 15452251CORRECTED2024Go to www.irs.gov/Form1094C

pdfFiller is not affiliated with IRS

Understanding and Utilizing IRS 1094-C

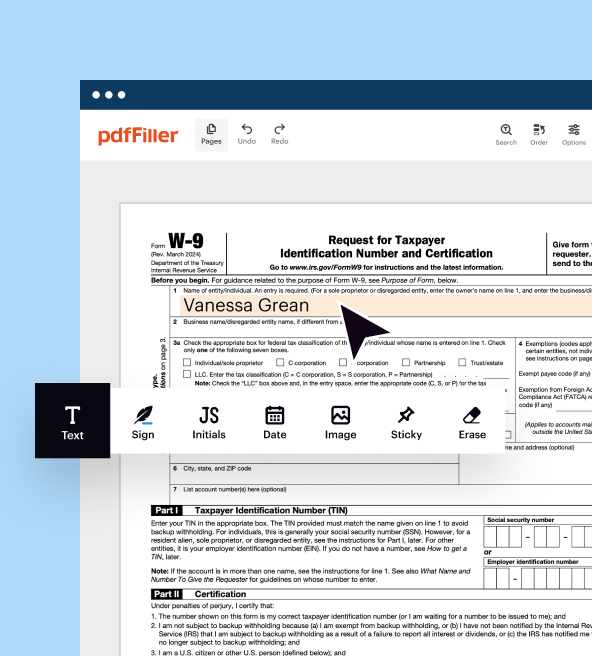

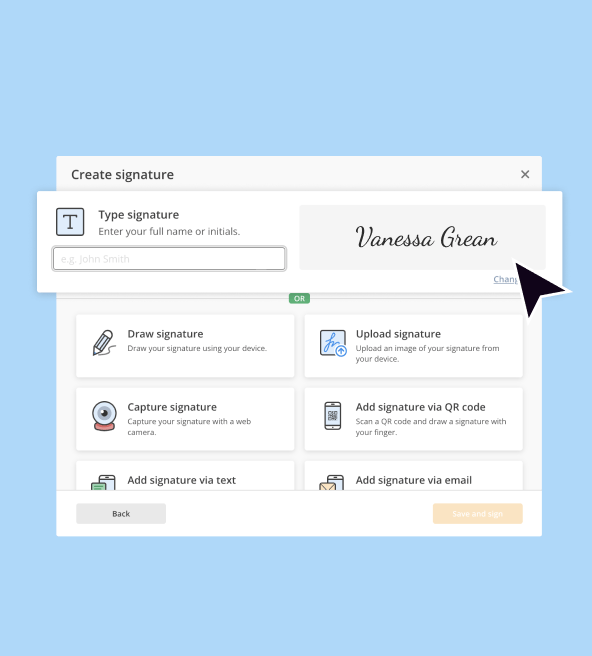

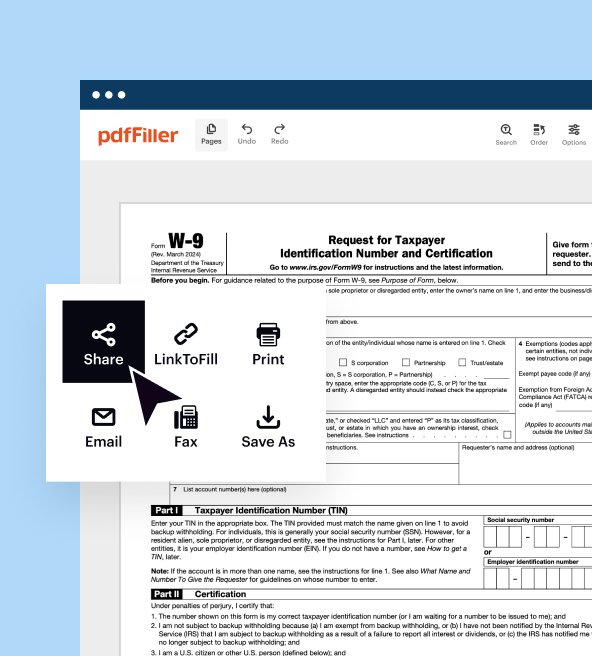

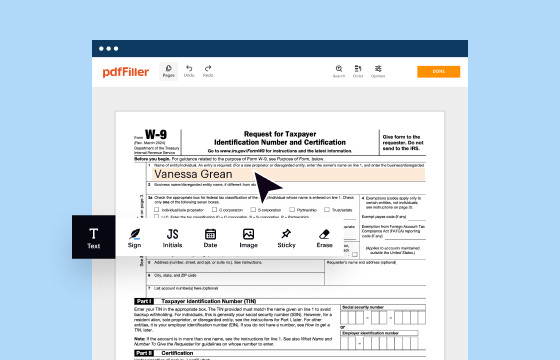

Detailed Guidance for Editing IRS 1094-C

Instructions for Completing the Form

Understanding and Utilizing IRS 1094-C

The IRS Form 1094-C serves as a crucial document for applicable large employers (ALEs) to report their employee health coverage to the IRS. This form is essential in demonstrating compliance with the Affordable Care Act (ACA) requirements. Understanding its importance not only helps in avoiding penalties but also ensures that employers are providing appropriate health coverage to their employees.

Detailed Guidance for Editing IRS 1094-C

To effectively edit the IRS 1094-C, follow these outlined steps:

01

Gather all necessary employee health coverage data from the previous year.

02

Verify the accuracy of employer identification numbers (EINs) and other identifying information.

03

Cross-check the list of employees against health coverage records to ensure all information is current.

04

Edit any outdated or incorrect information to reflect the current status of employee health coverage.

05

Review the form for mathematical accuracy, especially figures related to coverage offered.

06

Ensure compliance with all reporting requirements as stipulated by the ACA.

Instructions for Completing the Form

Filling out Form 1094-C requires attention to detail. Here are the steps to complete the form accurately:

01

Enter your EIN in the designated field.

02

Provide your ALE member information, including name, address, and contact details.

03

Fill out the required employee monthly coverage data for each month of the year.

04

Indicate the type of health coverage offered to employees.

05

Include the total number of full-time employees for each month.

06

Double-check that all information aligns with Form 1095-C data.

Show more

Show less

Latest Updates and Revisions to IRS 1094-C

Latest Updates and Revisions to IRS 1094-C

Recent changes to IRS Form 1094-C include the following:

01

New reporting requirements for minimum essential coverage that applies to all employees.

02

Updated definitions for full-time employees, reflecting changes in part-time employee calculations.

03

Raised thresholds for determining ALE status and associated reporting responsibilities based on company size.

Essential Insights on IRS 1094-C's Purpose and Functionality

Defining IRS 1094-C

Purpose of the IRS 1094-C

Who Needs to Complete This Form?

Understanding Exemptions from Filing

Components of the IRS 1094-C

Filing Deadline for IRS 1094-C

Comparison Between IRS 1094-C and Similar Forms

Transactions Addressed by IRS 1094-C

Copies Required for Submission

Penalties for Failure to File IRS 1094-C

Information Required for Filing IRS 1094-C

Accompanying Forms with IRS 1094-C

Where to Submit IRS 1094-C

Essential Insights on IRS 1094-C's Purpose and Functionality

Defining IRS 1094-C

The IRS 1094-C is an information return required by the IRS that summarizes health offer data submitted by ALEs. It serves as a transmittal form for Form 1095-C, which details the health coverage offered to full-time employees.

Purpose of the IRS 1094-C

This form is vital for establishing compliance with the ACA mandates. It provides the IRS with necessary details about the health coverage offered to employees and helps identify entities subject to penalties for non-compliance.

Who Needs to Complete This Form?

Any ALE, which is defined as an employer with 50 or more full-time or full-time equivalent employees, must complete the IRS 1094-C. This includes corporations, partnerships, government entities, and nonprofits that meet this threshold. For instance, a company with 55 full-time employees that also has 30 part-time equivalents must file this form.

Understanding Exemptions from Filing

Exemptions from filing the IRS 1094-C can apply under specific conditions, including:

01

Small employers with fewer than 50 full-time employees.

02

Employers with certain types of health plans that are not subject to ACA requirements, such as retiree-only health plans.

03

Specific industries may have additional exemptions based on state regulations.

Components of the IRS 1094-C

The form consists of several parts including:

01

Part I: Basic employer identifying information and contact details.

02

Part II: Information on health coverage offered, including months coverage was available to employees.

03

Part III: Counts of full-time employees and other relevant metrics.

Filing Deadline for IRS 1094-C

The filing deadline for the IRS 1094-C generally falls on the last day of February following the end of the tax year, or if filing electronically, it is due by March 31. For example, for the 2023 tax year, the deadline would be February 28, 2024, for paper filers and March 31, 2024, for those filing electronically.

Comparison Between IRS 1094-C and Similar Forms

The IRS 1094-C is often compared with IRS Form 1095-C. While 1094-C summarizes the information reported on 1095-C, it is not used to report individual employees' coverage data. Understanding these distinctions is crucial for accurate reporting.

Transactions Addressed by IRS 1094-C

This form primarily reports information regarding the health insurance coverage offered and provided to employees, ensuring compliance with federal healthcare mandates.

Copies Required for Submission

Generally, ALEs need to file one IRS 1094-C per employer, but they must also submit as many IRS 1095-Cs as necessary for each full-time employee, ensuring that all required forms are filed simultaneously.

Penalties for Failure to File IRS 1094-C

There are several levels of penalties for failure to submit Form 1094-C, including:

01

$50 per return: If filed late but before the 30 days' grace period.

02

$100 per return: If filed late beyond the 30-day grace period.

03

$250 per return: If intentionally disregarded. This could lead to serious legal implications.

Information Required for Filing IRS 1094-C

Key information needed includes the employer's EIN, contact information, total number of full-time employees, and details regarding the health coverage offered, including applicable months and types of coverage provided.

Accompanying Forms with IRS 1094-C

Form 1094-C is often submitted alongside Form 1095-C to provide a complete picture of the employer's health coverage offering for each employee and ensure compliance with ACA regulations.

Where to Submit IRS 1094-C

Form 1094-C should be submitted to the IRS at the designated address based on the filing method; whether filing by mail or electronically, ensure to follow the postal guidelines specified in the IRS instructions for proper submission.

Understanding the nuances of IRS Form 1094-C and ensuring compliance can significantly impact your organization’s adherence to healthcare laws. For more assistance with tax-related matters or Form 1094-C preparation, consider reaching out for professional help to streamline your reporting process.

Show more

Show less

Try Risk Free